The ins and outs of health insurance

The world of insurance can seem complicated, but it’s actually not that difficult. That’s why we’re happy to explain how health insurance works in a simple way.

Index

- What is basic health insurance?

- For whom is basic health insurance mandatory?

- What is included in basic insurance?

- Different types of health insurance

- What is supplementary insurance?

- Different health insurers

- Children are insured for free

- What is the deductible (eigen risico)?

- What is a co-payment?

- An overview of your healthcare costs

- What is healthcare allowance (zorgtoeslag)?

- What happens if you are not insured?

- Why should I switch health insurance?

- Important information for the health insurance for 2025

What is basic health insurance?

Basic insurance covers essential healthcare, such as visits to the doctor, prescribed medication, or hospital treatments. You pay a health insurance premium every month, even if you don't use any care.

Basic insurance is mandatory so that everyone contributes, ensuring access to healthcare for all. Not everyone can afford costly procedures like surgeries, but with basic insurance, these are covered.

For whom is basic health insurance mandatory?

Everyone who lives and/or works in the Netherlands is required to have Dutch basic insurance. If you return from abroad or move to the Netherlands for the first time, you will need Dutch health insurance. Even if you live abroad but work in the Netherlands, you are often required to have it.

In some cases, you can also change your health insurer or choose a health insurance policy outside of the switching season of health insurances

- You are or will soon be 18 years old

- You are co-insured and now want your own health insurance

- You come from abroad

- You change jobs and employer collective (group plan)

- You leave military service

- Your health insurer changes the policy conditions negatively for you

What is included in basic insurance?

All insurers are required to accept everyone for basic coverage, even those with poor health. The government determines what’s included in the basic package, but insurers can set their own premium prices, which is notable since the coverage is the same for everyone.

Different types of health insurance

There are three types of insurance policies:

- With a natura policy, the insurer decides which healthcare providers you can visit. To receive full reimbursement, your provider must have a contract with your insurer. If not, you might need to pay 25% of the bill.

- A restitution policy allows you to choose any healthcare provider. Contracts don’t matter. You pay the bill first and then claim reimbursement from your insurer.

- A combination policy mixes both. Some treatments allow freedom in choosing providers (like the restitution policy), while others don’t (like the natura policy).

What is supplementary insurance?

Basic insurance doesn’t cover everything. If you need care that’s not included, like physiotherapy or adult dental care, you can opt for supplementary insurance. However, assess if it’s worth it. For instance, annual dental checkups cost around € 50, but the cheapest dental insurance could cost over € 120 annually.

Different health insurers

There are many health insurers in the Netherlands. Some are more expensive than others, and some give you the choice of which hospital to go to, while others don’t. You can find all Dutch insurers in our comparison tool, which also shows which insurers are accepted by all hospitals.

Children are insured for free

Children under 18 are insured for free under their parents' basic policy. You must enroll your child with your insurer before they are 4 months old. Once they turn 18, they’ll need to pay their own premiums and can choose their own health insurance. It’s worth noting that dental costs for children are covered by the basic insurance, so there’s no need for a supplementary dental policy for them.

What is the deductible (eigen risico)?

For some care from the basic insurance, you must pay a deductible. The first €385 of healthcare costs in a year is paid by you, after which the insurer covers the remaining costs. Some costs are exempt from the deductible.

What does not fall under the deductible?

You don’t have to pay the deductible for General Practitioners (GP) visits, midwifery care, or treatments covered by supplementary insurance. Children’s healthcare costs are also exempt. Below is an overview of services covered by basic insurance that don’t require you to pay the deductible.

Increasing the deductible

If you expect low healthcare costs in a year, you can voluntarily increase your deductible in €100 increments, up to a maximum of €885. In return, you receive a discount on your premium. However, if unexpectedly high costs arise, you need to pay the full deductible amount, so it’s wise to have this money set aside.

What is a co-payment?

In addition to the deductible, you may also have to make a co-payment for certain services, where you cover part of the cost, and the insurer pays the rest. This applies, for example, to dentures, hearing aids, or maternity care. If both a co-payment and a deductible apply, you pay the co-payment first. The remaining amount is then subject to the deductible.

Example

A new denture costs € 1,000. You pay 25% co-payment (€ 250). From the remaining € 750, you pay the first € 385 (if your deductible hasn’t been used yet), and the insurer covers the remaining € 365 from basic insurance.

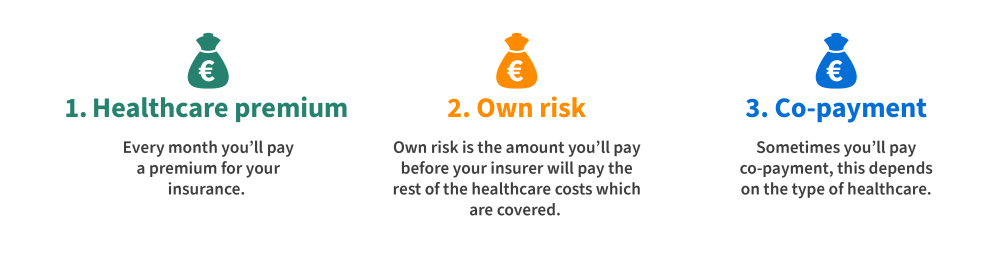

An overview of your healthcare costs

You pay a monthly premium for your basic insurance. You can choose to add supplementary insurance if desired. You cover healthcare costs up to the amount of your deductible, after which your insurer pays. Occasionally, a co-payment is required, depending on the type of care. You can also take out supplementary insurance to cover co-payment costs.

What is healthcare allowance (zorgtoeslag)?

Healthcare allowance helps cover part of your healthcare costs. This is the monthly amount you receive from the Tax Office, which you must apply for. The amount depends on your income and assets. The size of your healthcare allowance doesn’t depend on your premium. Not everyone is eligible for this benefit; only individuals over 18 with a modest income qualify.

What happens if you are not insured?

If you live or work in the Netherlands, you are required to have basic health insurance. If you fail to do so, you will have to cover all healthcare costs yourself. The Central Administration Office (CAK) will send you a notice, giving you three months to arrange insurance. If you don’t get insured within that time, you will receive a fine of € 382.50. If you remain uninsured, a second fine is imposed. After two fines, the CAK will register you with a health insurer and deduct the higher premium directly from your income.

Why should I switch health insurance?

Every year you can switch health insurance from mid-November to December 31. Then next year's new health insurance premiums will be known. Are you cancelling your old health insurance before January 1? Then you can even take out new health insurance until January 31.

The difference between the cheapest and most expensive basic health insurance is around € 36 per month. Over a year, this can add up to € 433 per adult family member. Additionally, another supplementary insurance plan might offer higher reimbursements, meaning you pay less out of pocket for medical expenses. In short, switching your health insurance provider can save you a significant amount of money.

Important information for the health insurance for 2025

- September 17: The deductible, healthcare allowance and average premium have been announced

- November 13: All new healthcare premiums for 2025 have been announced

- December 31: Last day to change health insurance

- January 31: Last day to find your health insurance if you have cancelled your old health insurance Plans for health insurance 2025 and beyond

These plans have already been announced for the 2025 health insurance:

- A new Transparency of Healthcare Providers Regulation will apply as of September 1, 2024. Healthcare providers with whom the health insurer does not have a contract must inform patients in advance that there is no contract and that this has consequences for the reimbursement.

- The basic insurance will become around € 11 per month more expensive in 2025. The increase will be partly compensated for by a higher healthcare allowance of € 6.50 extra per month.

- People with severe rheumatoid arthritis will receive exercise therapy reimbursed from the basic insurance from 2025.

- For people with COPD, there will no longer be a maximum for the number of exercise therapy treatments that they will be reimbursed from 2025.

- Older people will receive reimbursement for rehabilitation more quickly, for example after a broken bone or surgery.

Health insurance plans after 2025:

From 2027, the deductible will be reduced to € 165. You will also pay a maximum deductible of € 50 per treatment for specialist medical care (for example, hospital treatment) from that year onwards. This means that you can no longer owe the entire deductible for one treatment in the hospital.

Lesley was tot maart 2025 werkzaam als communicatiemedewerker & gediplomeerd adviseur zorg- en schadeverzekeringen bij Poliswijzer.nl. Lesley vindt het waardevol om mensen verder te helpen en te adviseren. Bijvoorbeeld door moeilijke informatie begrijpelijk te maken. Zodat onze websitebezoekers verzekeringen eenvoudig en eerlijk met elkaar kunnen vergelijken. Het continue verbeteren van de website is dan ook elke dag vaste prik.